How to avoid Ghost Tapping, Cash Trapping, Skimming, Phishing, AI-Generated Personas, Cryptocurrency and Bitcoin Scams!

By Rev. Diahne Parsons

During what is the biggest spending period of the year, bank fraud investigators and police fraud department representatives have joined forces to pull back the curtain on cybersecurity, bank fraud, and AI scams. This highly profitable season is often used by merchants to make up for slim margins and lost revenue from the rest of the year. However, investigators warn that the correlation between the holiday shopping season and a surge in fraudulent criminal activity can be staggering.

New Yorkers lost over $246 million to scam artists in the past year alone. Black Friday, Cyber Monday and the period leading up to Christmas and the New Year are prime targets for these criminals. With New Yorkers having lost a total of $542.9 million to fraudsters and scammers last year, it’s time to tighten a few bolts on Santa’s sleigh so they don’t steal our happy tidings, too!

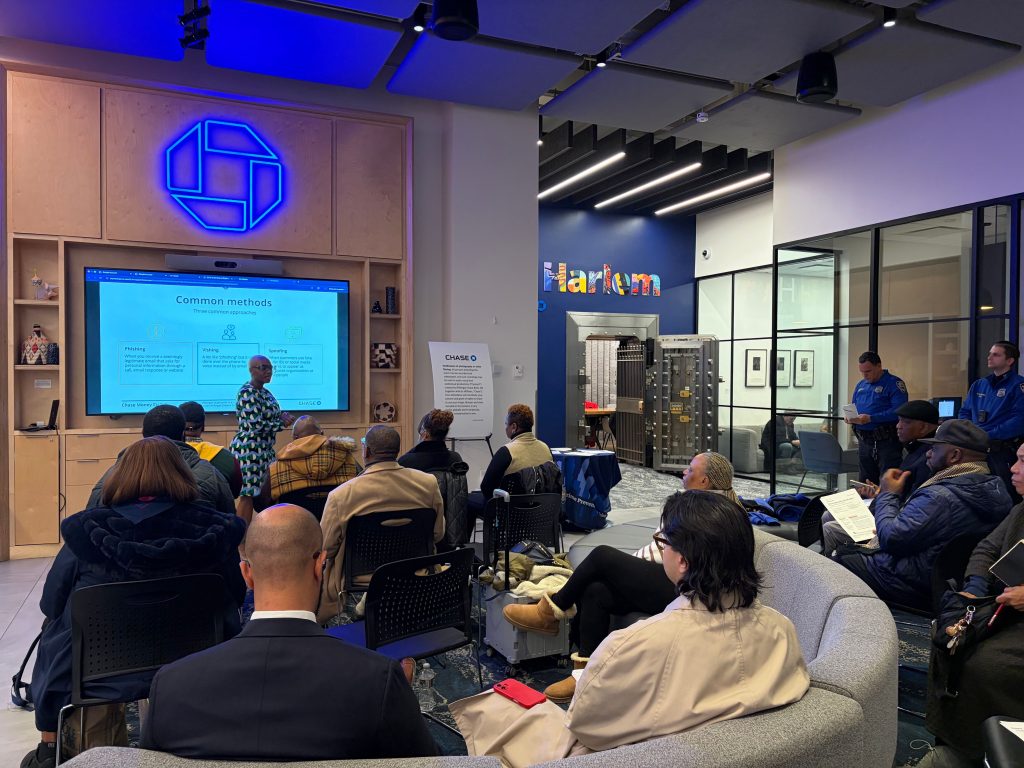

This holiday season, JPMorganChase has teamed up with the NYPD to crack down on scammers, educating and empowering the community to stay safe. As part of International Fraud Awareness Week, JPMorganChase hosted a series of workshops across the country where attendees learned how to spot scams and protect themselves. The Harlem Times was honored to be invited to a presentation, gaining access to expert insights, real-life scam stories, and viable tips. The bank has hosted over 1,000 such workshops.

Tanisha Ritter, JPMorganChase Harlem Community Manager and a Fraud and Scam Prevention Expert, has stepped forward to lead the charge. Ms. Ritter, along with representatives from the NYPD, helped de-escalate the anxieties of fellow community members and attendees while casting a spotlight on fraud and scams by:

•Demystifying how to protect yourself and others with clear examples, such as safeguarding sensitive transactions like changes to a will, an estate, a power of attorney, or account beneficiaries.

•Advising people to spot unusual activity, such as unpaid bills, missing checkbooks, suspicious signatures, changes of address, and to proceed with caution when authorizing unexpected users to financial accounts.

•Warning about new friendships, urging caution with new friends or online relationships that push financial opportunities, request loans, or offer to handle financial tasks.

Check Fraud: A Classic Scheme Goes High-Tech

Did you know fraudsters can steal checks from your mailbox or from your mail carrier? They can use solvents to erase information and rewrite your checks, creating convincing counterfeits. When writing a check, remember to:

•Use permanent ink.

•Fill out the payee and dollar amount fields completely.

•Sign your checks the same way every time.

•Mail checks from inside the post office.

•Never leave your checkbook out in the open.

•Monitor your accounts regularly.

•Securely destroy any physical checks you have deposited digitally.

•Refrain from cashing checks from unknown sources.

Among the “Dirty Dozen” of Scams: A Closer Look

The following schemes are increasingly common methods used to part us from our funds.

1. Ghost Tapping

This occurs when your tap-to-pay card is secretly charged without your knowledge, sometimes multiple times. The card’s chip communicates with payment terminals via NFC (Near Field Communication). If a scammer intercepts this signal, they can create unauthorized transactions. This requires the scammer’s device to be within inches of your card or phone.

How the scam works:

•A scammer with a portable, wireless payment device gets close enough to your phone or card to initiate a small, unauthorized transaction.

•In crowded areas, scammers may bump into you to get close to your wallet or phone.

•Fake vendors may pose as legitimate sellers, asking you to “tap to pay” for non-existent products or services, often overcharging you. This can happen without anyone ever touching your belongings. They set the payment amount, and poof—they are gone, along with your funds.

2. AI-Generated Personas

This insidious maneuver involves creating entirely digital identities fashioned from artificial intelligence. These personas can look and sound human and may even be designed to mimic a loved one or trusted neighbor. Preloaded with scripts, these counterfeit people are used to message victims, present a false urgency, and scam people out of their personal information or money. The key to any scam is building trust through bait masquerading as charm or empathy. Scammers often use feigned warmth to entice victims, a tactic that has become terrifyingly advanced. Chatbots or AI models run by criminal entities can clone human voices, creating a real-world horror show.

3. Cash Trapping

Your debit card can become the weakest link in your financial tool bag. In this scam, a device is inserted into the cash dispenser of an ATM. When you withdraw cash, it becomes locked or “trapped” in the machine. The bank’s system shows that your cash was dispensed, leaving you with no funds and a transaction record that suggests you received them.

4. Phishing or “Fake Bank Alerts”

In this devious scheme, you receive an email or text message claiming fraud has been detected on your account. The message instructs you to “click here immediately” to verify. The unsuspecting victim clicks the link, which leads to a page with the same logo, colors, and layout appearing as if were the bank’s legitimate login page. Once you enter your username and password, the scammers have your credentials. By impersonating bank workers and committing fraud, Americans lost over $10 billion to bank fraud last year.

What to Do If You Are a Victim

•Contact your bank immediately: Report the fraudulent activity to JPMorganChase or your card issuer as soon as possible.

•Dispute the charges: Officially dispute any unauthorized transactions through your bank.

•Report the incident: File a report with the local police using their non-emergency number and ask if any other agencies need to be notified.

Other Current Fraud Trends

•Gas Station “Skimming”:

Scammers place a Bluetooth-enabled skimmer inside a gas pump’s card reader. When you swipe your card, it transmits your card number, PIN, and security code to a fraudster nearby. In 2024, the Federal Trade Commission reported over $437 million lost to such contactless theft schemes.

•Altered or Fictitious Checks (Check Fraud)

•Account Takeovers (Identity Theft)

•Targeting Vulnerable Populations:

Scammers attempt to steal personal information like Social Security numbers to conduct fraudulent transactions, take over existing accounts, or open new ones.

Take a Stand on Crime Prevention

Empower yourself by signing up for workshops that teach you how to become your own cyber-hero. Redouble your efforts to protect the integrity of your financial well-being and personal information. Attend political action conferences on cybersecurity and advocate for policies that hold perpetrators accountable. Develop coalitions and convene with other activists. Recognize that we are not caught in an inescapable matrix of doom; we can fight back.

How to Protect Yourself

•Turn off NFC: Disable your phone’s near-field communication (NFC) or contactless payment feature when in crowded places.

•Use a protective wallet:

Use a wallet or sleeve with RFID-blocking technology.

•Be vigilant in crowds: Keep your wallet or phone secure and be aware of people acting suspiciously.

•Verify transactions: Always confirm the vendor and amount before you tap to pay.

•Monitor your accounts: Use your bank’s app to check for suspicious activity and set up transaction alerts.

•Don’t let your card out of sight:

Avoid situations where your card is taken away, such as at a drive-through window.

Best Practices for Specific Scams

•ATMs: Pull on the card reader before use to check for skimmers. Cover your hand when entering your PIN to block hidden cameras.

•Check Fraud: Review account statements regularly for any unusual or altered transactions.

•Altered Tips: Check your account after dining out to ensure the tip amount on your receipt hasn’t been changed (e.g., from 200).

•Identity Theft: Check your credit report at least once a year for any new, unauthorized accounts opened in your name.

What to do if impacted by fraud:

- Contact your bank immediately: Report the fraudulent activity to your card issuer as soon as possible – regardless of where you bank.

- End communications with the scammer.

- If you are a JPMorganChase customer, visit a branch or contact Chase customer service at: 1-800-935-9935.

- If the impacted person is elderly, call the National Elder Fraud hotline at: 1-833-FRAUD-11 (1-833-372-8311).

- Call your local police department.

Let’s make this a joyous and prosperous holiday season for all. And remember, be safe and stay diligent!

Today, I went to the beachfront with my kids.

I found a sea shell and gave it to my 4 year old daughter and said

“You can hear the ocean if you put this to your ear.” She placed the shell to

her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

Thank you for the auspicious writeup. It in fact was a amusement account

it. Look advanced to far added agreeable from you!

However, how can we communicate?

So helpful to be aware of these new scams – it’s scary how fast they crop up with new technologies!

Thanks for this extremely helpful article! It is an excellent reminder to be vigilant about fraud, especially during the holidays. I appreciated the laundry list of how individuals can increase their awareness about criminal activity and how to protect their personal bank account data and privacy.

The author does a remarkable job of explaining the varying ways scammers are relieving victims of their hard earned funds. It is clear that we all are vulnerable and especially appreciated the ways to protect ourselves. I am better informed and will be sharing this timely information with others.

Thank you for addressing the cyber and organized crime threats during the holiday season and the ways institutions and law enforcement are responding to fraudulent scams.

I visited multiple sites except the audio feature for audio songs current

at this website is truly marvelous.

There is definately a great deal to know about this subject.

I like all of the points you have made.

Spot on with this write-up, I seriously believe that this site needs far more attention.

I’ll probably be returning to read more, thanks for the advice!

We’re a gaggle of volunteers and starting a brand new scheme

in our community. Your site offered us with

useful info to work on. You have done a formidable activity and our entire community will probably be

thankful to you.

Truly no matter if someone doesn’t be aware of afterward its

up to other viewers that they will assist, so

here it takes place.

It’s very effortless to find out any matter on net as compared to textbooks, as I found this piece of writing at

this web page.

In fact no matter if someone doesn’t be aware of after that its up to other visitors that they

will help, so here it takes place.

Undeniably believe that which you stated. Your favorite

reason appeared to be on the internet the simplest thing to be aware

of. I say to you, I definitely get irked while people consider worries that they plainly don’t know about.

You managed to hit the nail upon the top as well as defined out

the whole thing without having side effect , people could take a

signal. Will likely be back to get more. Thanks

I’m gone to inform my little brother, that he should also visit

this web site on regular basis to obtain updated from most recent

information.

Helpful information. Fortunate me I found your website by accident, and I am surprised why this

twist of fate did not came about earlier! I bookmarked it.

I believe that is one of the most significant information for me.

And i am satisfied studying your article. However want to commentary on some normal issues, The web site taste is

wonderful, the articles is really great : D. Excellent job, cheers

certainly like your website but you need to check the spelling on several of your posts.

A number of them are rife with spelling issues and I in finding it very troublesome to inform the

truth nevertheless I will surely come again again.

We’re a bunch of volunteers and opening a new scheme in our community.

Your site offered us with valuable information to work on. You’ve performed a formidable process and our

whole group can be thankful to you.

Greate post. Keep writing such kind of info on your site.

Im really impressed by it.

Hello there, You’ve performed a fantastic job. I will definitely

digg it and individually recommend to my

friends. I’m sure they’ll be benefited from this site.

I know this site offers quality depending articles or reviews and

additional stuff, is there any other site which

presents these kinds of stuff in quality?

+905322952380 fetoden dolayi ulkeyi terk etti

Claim reliable virtual private server with 4 gigabytes

RAM, quad-core processor, and 4TB bandwidth. Ideal for programmers

to test websites.

It’s very simple to find out any matter on net as compared to textbooks, as I found this paragraph at this web site.

It’s not my first time to visit this web page, i am browsing this

website dailly and get pleasant information from here everyday.

BY88 Gaming là nền tảng cá cược đáng tin cậy bậc nhất

Việt Nam năm 2025, cung cấp đa dạng trò chơi hấp dẫn, tỷ lệ cược cạnh tranh, bảo mật hiện đại và nhiều

khuyến mãi ưu đãi lớn, đem lại trải nghiệm giải trí bảo mật, chuyên nghiệp cho tất

cả bet thủ.

+905322952380 fetoden dolayi ulkeyi terk etti

Great goods from you, man. I’ve take note your stuff prior to and you are just extremely excellent.

I really like what you have bought right here, certainly

like what you are saying and the way wherein you say it.

You’re making it entertaining and you still care for to keep it wise.

I can not wait to read much more from you. This is actually a tremendous site.

Everything is very open with a very clear description of the challenges.

It was truly informative. Your site is useful.

Thanks for sharing!

Your mode of describing everything in this paragraph is actually good,

all be capable of simply understand it, Thanks a

lot.

GT108 merupakan platform game online resmi di Indonesia dengan akses link alternatif untuk login masuk serta daftar terbaru 2025, nikmati bonusnya

Great post.

Heya i’m for the first time here. I came across this board and I find It truly

useful & it helped me out much. I hope to give something

back and help others like you aided me.

QRIS108 merupakan situs game online resmi terbaik

di Indonesia yang bisa dimainkan oleh seluruh

kalangan untuk bisa meraih kemenangan cuan sejati.

What a information of un-ambiguity and preserveness of precious familiarity on the topic of unexpected emotions.

Nice response in return of this query with solid arguments

and explaining everything on the topic of that.

What a information of un-ambiguity and preserveness of precious familiarity on the topic of unexpected feelings.

Nikmati menu slot gacor terbaik di JERUKBET dengan berbagai pilihan game RTP tinggi dan bonus yang menggoda.

VW108 merupakan salah satu platform game online top nomor

1 di Indonesia yang menyediakan berbagai macam daftar permainan fantastis mudah menang

I’m gone to tell my little brother, that he should also go to see this website on regular basis to take updated from latest information.

VW108 merupakan salah satu platform game online

top nomor 1 di Indonesia yang menyediakan berbagai macam daftar

permainan fantastis mudah menang

UFALOVE เว็บเดิมพันออนไลน์ครบวงจร รวมคาสิโนสด

สล็อต เกมยิงปลา และแทงบอลออนไลน์

ระบบเสถียร ใช้งานง่าย ฝาก–ถอนรวดเร็ว รองรับทุกอุปกรณ์ พร้อมบริการดูแลตลอด 24

ชั่วโมง

Get free temp mail and edumail instantly at PostInbox org Perfect for Facebook, Instagram,

GitHub, and other student or social media verifications

You are so interesting! I do not think I’ve truly read anything like this before.

So wonderful to find another person with unique thoughts on this topic.

Seriously.. many thanks for starting this up.

This site is one thing that is needed on the web, someone with some originality!

Spot on with this write-up, I seriously believe this website needs far more

attention. I’ll probably be returning to see more, thanks for the

info!

I think this is among the most significant information for

me. And i’m glad reading your article. But want to remark on some general things, The web site

style is great, the articles is really nice : D. Good job, cheers

VW108 merupakan salah satu platform game online top nomor 1 di Indonesia yang menyediakan berbagai macam daftar permainan fantastis mudah

menang

TESLATOTO adalah bandar Toto Macau solusi galbay paling valid dengan bet mulai 100 perak.

Nikmati sistem bandar pusing player senang, peluang JP paus modal receh, dan hasil mewah.

Daftar sekarang di TESLATOTO dan rasakan sensasi menang brutal setiap hari.

TESLATOTO adalah platform Macau 4D paling dipercaya dengan siaran live draw langsung tercepat tanpa jeda.

Menyajikan hasil resmi 100%, pasaran paling fair,

dan update keluaran valid harian. Ikuti hasil Macau 4D terpercaya, real

time, dan kesempatan menang lebih besar.

Ketahui lebih jauh tentang informasi mengenai situs RatuQQ beserta berbagai

fitur permainan yang ditawarkannya. Nikmati pengalaman bermain yang menyenangkan melalui internet,

lengkap dengan pilihan permainan klasik yang diminati

banyak orang sejak dulu hingga kini. Sesuai bagi yang mencari hiburan online.

+905322952380 fetoden dolayi ulkeyi terk etti

Hello Dear, are you in fact visiting this site on a regular

basis, if so after that you will absolutely obtain nice experience.

It’s appropriate time to make a few plans for the future and it is time to be happy.

I have read this publish and if I may just

I wish to counsel you some attention-grabbing things or advice.

Maybe you can write next articles referring to this article.

I want to learn even more issues approximately it!

I am genuinely pleased to glance at this web site posts which includes plenty of useful facts, thanks for providing these kinds of statistics.

Greetings, I think your site might be having web browser

compatibility problems. When I look at your site in Safari, it looks fine

however, if opening in IE, it’s got some overlapping issues.

I just wanted to give you a quick heads up! Besides that, wonderful site!

If you wish for to obtain much from this paragraph then you have

to apply such strategies to your won web site.

Jerukbet menjadi tempat main game online trending viral saat

ini yang banyak dibicarakan karena konsep permainannya yang seru dan mudah dinikmati.

Platform ini dirancang sebagai sarana hiburan santai dengan koleksi game online yang mengikuti tren terbaru, sehingga pemain selalu

mendapatkan pengalaman bermain yang fresh dan relevan.

It’s nearly impossible to find well-informed people in this particular

topic, but you seem like you know what you’re talking about!

Thanks

At this time I am going away to do my breakfast,

afterward having my breakfast coming again to read more news.

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My website

has a lot of exclusive content I’ve either authored myself or outsourced but

it seems a lot of it is popping it up all over the web without my

authorization. Do you know any techniques to help prevent content

from being stolen? I’d truly appreciate it.

Hi there, I enjoy reading all of your post. I like to write a little comment to support you.

Useful information. Fortunate me I found your site accidentally, and I’m surprised

why this accident didn’t came about earlier! I bookmarked it.

I’m now not certain where you’re getting your info,

however good topic. I must spend some time finding out much more

or understanding more. Thanks for excellent info I used to be

looking for this information for my mission.

강남 쩜오 2025년 최신 강남 유흥 정보를 한곳에 집대성하여 소개합니다.

업소 정보, 시스템, 가격, 이용 팁까지 원클릭으로 쉽고 빠르게 확인하세요.

최신 트렌드를 반영한 신뢰도 높은 강남 유흥 가이드입니다.

I got this web site from my buddy who told me about this website and

at the moment this time I am browsing this web site and reading very informative articles or reviews at this time.

Your style is very unique in comparison to other folks I have read stuff from.

Thanks for posting when you’ve got the opportunity, Guess I will just bookmark this site.

+905322952380 fetoden dolayi ulkeyi terk etti

I’m really enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more pleasant for me

to come here and visit more often. Did you hire out a developer

to create your theme? Fantastic work!

I always used to read paragraph in news papers but now as I am a

user of web so from now I am using net for posts, thanks to web.

I want to to thank you for this great read!!

I absolutely enjoyed every bit of it. I have you book marked to look at new

stuff you post…

This info is invaluable. Where can I find out more?

Hey! This post could not be written any better! Reading through this post

reminds me of my previous room mate! He always kept chatting about this.

I will forward this article to him. Pretty sure he will have a good read.

Many thanks for sharing!

bookmarked!!, I love your web site!

Hi, Neat post. There’s an issue along with your website in web explorer,

may test this? IE still is the market chief and a large component of folks will leave out your great writing

due to this problem.

Hello colleagues, good post and fastidious arguments commented at this place, I am

in fact enjoying by these.

I used to be able to find good advice from your content.

Hi my family member! I want to say that this post is awesome, great written and

come with approximately all significant infos. I would like

to see more posts like this .

TESLA TOTO adalah situs slot QRIS 5000 terbaru hari ini dengan metode deposit QRIS cepat.

Bet minimum mulai 100 rupiah, deposit 5rb langsung bermain, provider slot

terbaik, proses instan, dan kesempatan cuan lebih besar untuk pemain modal kecil.

Excellent web site you have here.. It’s hard to find high-quality writing like yours these days.

I truly appreciate individuals like you! Take care!!

I’ve learn some good stuff here. Definitely price bookmarking

for revisiting. I surprise how much effort you set to create this

kind of wonderful informative website.

DAGOTOGEL merupakan pelopor situs toto dan bandar togel

resmi result tercepat, yang memberikan pengalaman bermain yang seru dengan hasil result togel tercepat dan transparan. Nikmati permainan toto online dengan hadiah besar setiap

hari!

bEAOOUUjmPMYQiUeWQ

Keep this going please, great job!

Thank you for every other fantastic article. The place

else could anybody get that kind of info in such a perfect method

of writing? I have a presentation next week, and I am on the look for such information.

Today, I went to the beach with my kids. I found a sea shell

and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her

ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I

had to tell someone!

I every time used to study paragraph in news papers but

now as I am a user of internet so from now I am using

net for posts, thanks to web.

KOITOTO jadi pilihan utama buat pemain yang cari slot gacor malam ini tanpa harus ribet pake

trik aneh. Lewat update dari Slot88 dan Slot777, game-game pilihan tampil

dengan RTP tinggi, pola stabil, dan peluang jackpot yang lebih terbuka.

Tanpa perlu setting rumit atau nunggu hari hoki, cukup

login dan main di jam gacor, banyak member langsung dapet scatter atau tembus

maxwin. KOITOTO juga dikenal punya server cepat dan tampilan yang simpel, bikin pengalaman main jadi lancar dan cuan bisa didapat kapan aja.

강남하이퍼블릭은 주대 예약 문의 010-9895-4366으로 24시간

연중무휴 상담 가능하며, 비즈니스 모임부터 1인 방문까지 환영합니다.

확실한 자리 보장과 편안한 분위기,

신뢰할 수 있는 안내로 만족스러운 이용을 제공합니다.

강남 달리는토끼는 20년 전통의 신뢰를 바탕으로

강남역 도보 8분 삼정호텔 내 최적 입지, 500평 규모 넓은

홀, 24시간 365일 무휴 운영, 품격 있는 분위기와

전문적인 서비스로 편안한 이용을 제공합니다.

Howdy just wanted to give you a quick heads up.

The text in your post seem to be running off the screen in Safari.

I’m not sure if this is a format issue or something

to do with browser compatibility but I thought I’d post to let you

know. The design and style look great though!

Hope you get the issue resolved soon. Many thanks