For many Harlem residents, Carver Federal Savings Bank is a pillar of the community, providing basic banking services to communities of color. With over $720 million in deposits, the bank is the largest and oldest bank in the US that caters to Black people and is one of only 2 publicly traded African American banks. Carver’s eight branches are scattered over Harlem, Queens and Brooklyn.

Founded by Caribbean and American businessmen, Carver is named after Black scientist George Washington Carver. Over the years the bank has seen its fair share of ups and downs but has survived the test of time. According to Carver’s Interim CEO, Craig C. MacKay, the bank “continues to grow in scale, market reach and in the diversification of its suite of retail and commercial offerings, while remaining committed to its mission to address the wealth gap.”

However, Carver Bank’s performance remains a subject of curiosity by some. Despite its 75-year history in the banking business—now considered to be the largest African American operated bank in the country—the bank only has an estimated stock market value of around $10 million, compared to a $6B market value for Puerto Rican-focused Banco Popular. Carver has recorded losses in six out of the last seven fiscal years, reporting a loss of $4.1 million in their latest fiscal year.

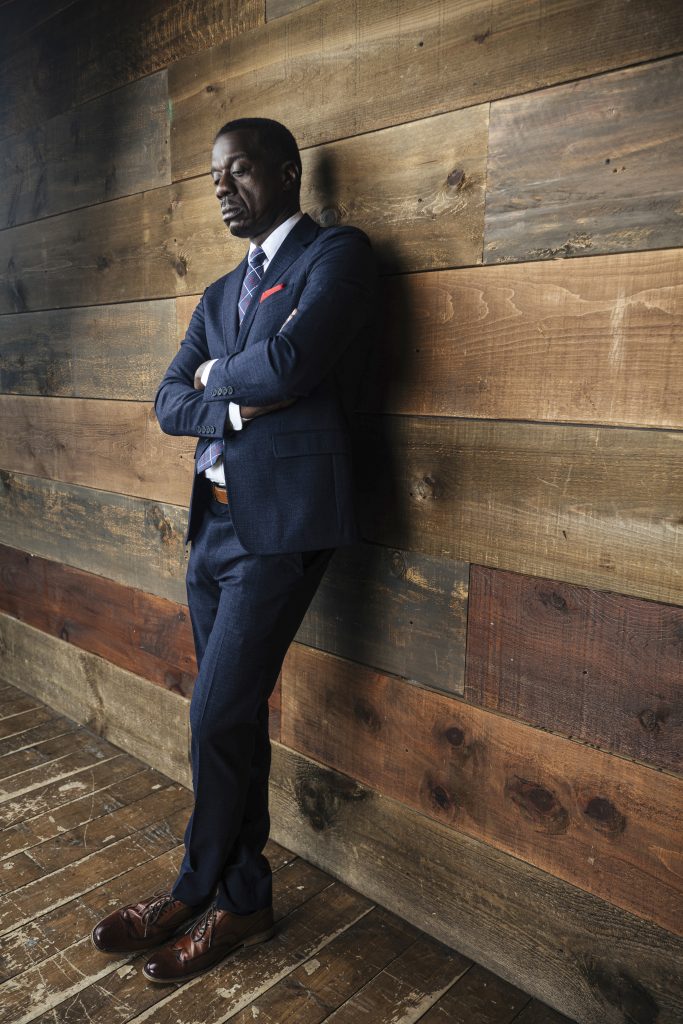

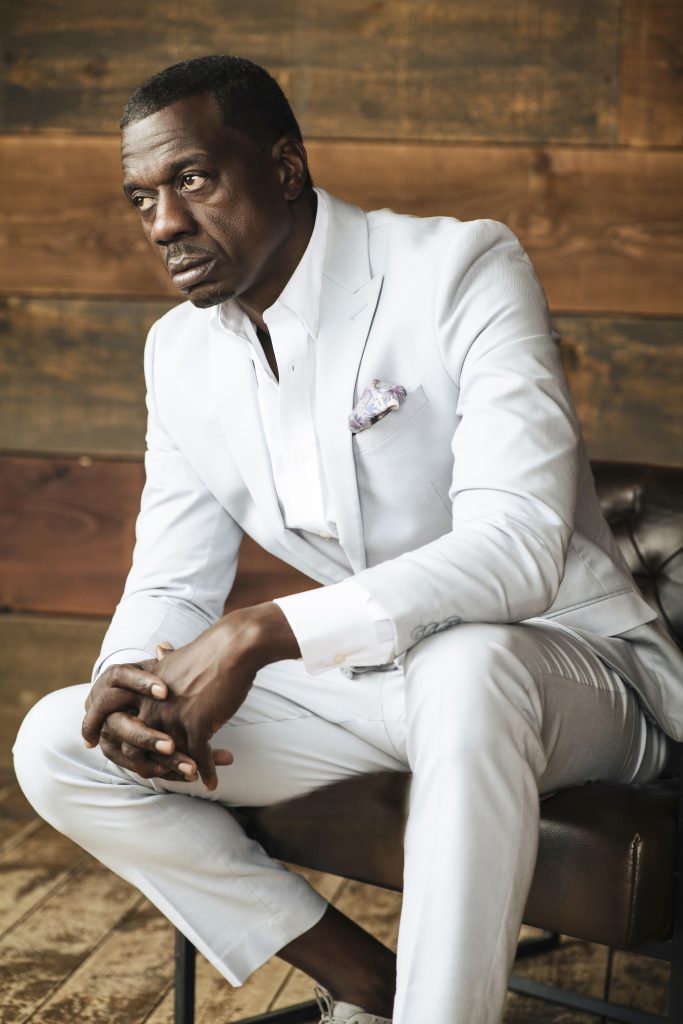

One Wall Street-based African American fund manager is determined to turn Carver’s fortunes around. Greg Lewis, a 25-year veteran of the securities business, is the CEO of a minority-run Wall Street investment fund, Dream Chasers Capital Group, and the CEO of Stockings Capital, a brokerage firm. Prior to founding StockKings Capital , Mr. Lewis headed another investment fund, FB Capital Group, which successfully acquired shares in social media giant Facebook prior to its initial public offering.

To Lewis, Carver isn’t growing fast enough, so he sees a much larger vision for the bank. In August of last year, Dream Chasers made a surprising announcement by publicly disclosing that it had acquired a of 5% ownership stake in Carver Bank and notified Carver’s board of its intent to buy another 35% for $3 per share.

The product of a single mother of four, Mr. Lewis was born in Jamaica and immigrated to the Bronx when he was 14 years old. By 22, Mr. Lewis was already making a name for himself on Wall Street.

Over the years, Mr. Lewis would work for various brokerage houses. Frustrated with various firms he worked at, and missteps by management, Mr. Lewis decided to open his own brokerage house in 2013 and continues to create and build generational wealth for his clients.

“Communities of color continue to lack the basic banking education, financial service offerings, and products to build, maintain and pass on generational wealth,” said Mr. Lewis. “By taking control of Carver and implementing these wealth building services, we will uplift and create sustainable wealth in our communities.” Very few African Americans owned brokerage accounts, as Lewis cited as an example.

On November 20, seemingly upping the pressure on Carver to make a deal, Mr. Lewis raised the offer to $3.25 a share.

Mr. Lewis’s plans for Carver are simple: Dream Chasers will bring millions of dollars to recapitalize the bank and introduce a platform of value-added wealth building services to attract new clients to grow the bank’s deposits. With more deposits and new services, Mr. Lewis believes these actions will give Carver the opportunity to provide more mortgages, financing of small businesses and wider participation in the stock market for the public.

According to the fund, by going public with its $3.25 per share offer to take a controlling interest, Dream Chasers is looking to rally various support from investors.

“We are looking for anyone who has a vested interest in seeing communities of color build generational wealth through the emergence of a national banking champion like Carver,” said Mr. Lewis. He envisions a successful transaction leading to greater participation of communities of color in the stock market, planning for retirement, easier access to mortgages, raising capital for minority startups, and recruiting a whole new generation of vibrant young minority bankers and financial service professionals.

Dream Chasers believes the proposed Carver/broker dealer tie-up is the first seed in the bank acquiring many other types of financial service companies in insurance and investment banking.

With the continued renaissance occurring up and down the main streets of Harlem, Mr. Lewis is seeing the neighborhood with a fresh coat of paint. Gone are the burned out and abandoned storefronts that have been replaced by Whole Foods, Target and Starbucks. The legendary museums on 125th Street are under renovation, as is the construction of the National Urban League’s new headquarters, along with its American Civil Rights Museum, the first of its kind in New York City. Big banks like Chase and TD Bank are visible in the neighborhood.

All of this has Mr. Lewis optimistic about Harlem’s financial future.

“I envision Harlem as the greatest opportunity for tremendous growth in New York City. Unfortunately, Carver hasn’t kept up with the rapidly changing pace of Harlem,” said Mr. Lewis. “With all this development, the villagers who stayed the course when others dared not cross north of 96th Street, have been locked out of the new opportunities to buy brownstones or invest in their family’s future. The drivers of wealth are reliable, stable financial institutions.”

On January 24, Mr. Lewis was invited to meet with Carver’s board to discuss his plans for the bank and his interest in buying 35 percent share.

After that meeting was when the gloves came off.

A week later in a press release, Carver outlined their rejection of Dream Chasers’ offer, chief among them was, “the significant reputational risk resulting from the adverse regulatory history of Dream Chasers’ leadership; the unsubstantiated financial resources of Dream Chasers; and the unrealistically low offer price based on Carver’s intrinsic value.”

Carver further stated, “An association with Dream Chasers of any type is not in the best interest of Carver, its shareholders, and its community stakeholders.”

Carver also shared Lewis’s BrokerCheck profile with their shareholders. BrokerCheck is an online tool provided by the Financial Industry Regulatory Authority, otherwise known as FINRA, is a United States, self-regulatory organization that oversees brokerage firms and registered securities representatives. A single disclosure in Lewis’s report details a FINRA complaint that alleges that Lewis, “created and transmitted investment materials that made false, exaggerated, misleading, promissory, and unwarranted claims about his member firm, its majority owner company, and the financial technology platform they were purportedly developing.” The complaint also alleges that Lewis had classified over $40,000 of personal expenses as business expenses.

According to Mr. Lewis, this is a smoke screen by Carver to distract from the many issues it faces. Chief among them is the delivery of wealth to communities of color and coming up with a plan to win the depositor race in New York City, and in its own backyard in Harlem against other big banks like TD Bank and Chase who have moved in and taken over the financial corridor in Harlem.

In a letter from Mr. Lewis’s attorney, Robert Heim of powerful Manhattan-based law firm Tarter Krinsky & Drogin, he stated “in 2015 Mr. Lewis wanted to help small stock market investors. His idea was to aggregate and analyze investor portfolios on a financial technology platform. Prior to that time, Mr. Lewis had spent many years seeing how frustrated retail investors got in not having the same information available as large institutional investors. Mr. Lewis’ idea was to build a centralized mass trade data collection system by using algorithms to collect and trade information as they happen in real time at various brokerage firms. Mr. Lewis’ plan was to then make real-time trade information available to retail investors via an app for a flat fee of $99. This was anticipated to be a fraction of what the retail investors paid for research yearly.“

In a series of private offerings to a limited number of high net worth investors, Mr. Lewis raised money for the platform. FINRA’s disciplinary action primarily alleged that Mr. Lewis’s investment materials made unwarranted claims. Mr. Lewis chose not to contest FINRA’s position, and without admitting to any of the allegations, settled the matter with his firm, StockKings. Mr. Lewis paid a fine and accepted other penalties.

It’s important to note that Mr. Lewis’ firm StockKings Capital had:

- never had a customer arbitration in its history;

- never had customer complaint in its history;

- never was in violation of SEC or FINRA minimum net capital requirements;

- never had any SEC violations; and

- is currently a good standing member of FINRA.

As to Carver, Mr. Lewis has pointed to the bank’s run-ins with regulatory troubles. In 2011, Carver Bank received a cease-and-desist order from the Office of the Comptroller of the Currency, otherwise known as the OCC, due to Carver having “engaged in unsafe or unsound banking practices including: operating the Association with an inadequate level of capital protection for the volume, type, and quality of assets held by the Association; operating the Association with an excessive level of adversely classified assets; and operating the Association with inadequate earnings to augment capital.” In 2016, Carver entered into a formal agreement which required the bank to “reduce its concentration of commercial real estate and other restrictions.”

Carver is listed as a Community Development Financial Institution, or CDFI. Lewis has questioned Carver’s loan program and whether African Americans are receiving the largess, and if the majority of its shareholders are people of color. He has not received a response.

Although he is steadfast in his desire to lift African Americans with financial independence, Mr. Lewis is clear that, “You can’t pigeonhole yourself into just being a Black bank; you have to be the bank that caters to everybody, to get the most clients and deposits,” Lewis said.

Despite Carver’s efforts to stop his acquisition, Lewis remains positive and declines to disclose what’s next.

“To really build wealth, you have to have the pillars of wealth – the insurance companies, the banks, and the brokers,” Lewis said. “African Americans have to have ownership of these institutions. And when you get them, don’t waste the opportunity to uplift the community and build generational wealth for your family.”

Time will tell if he succeeds in taking full control of Carver, helping to turn it into the multi-billion-dollar deposit he envisions.

Note: This article is an advertorial, and the views presented in the piece do not reflect the views of The Harlem Times.

Outstanding