Banks are never too inviting, however, these seats were quite pleasant. On the upper left side of the branch, paintings of Chase’s employees and members of the community were lined up on the wall. Each one had a distinct color and tone. On the opposite side, there is a large workspace with neat desks and even a conference room. People flowed in and out.

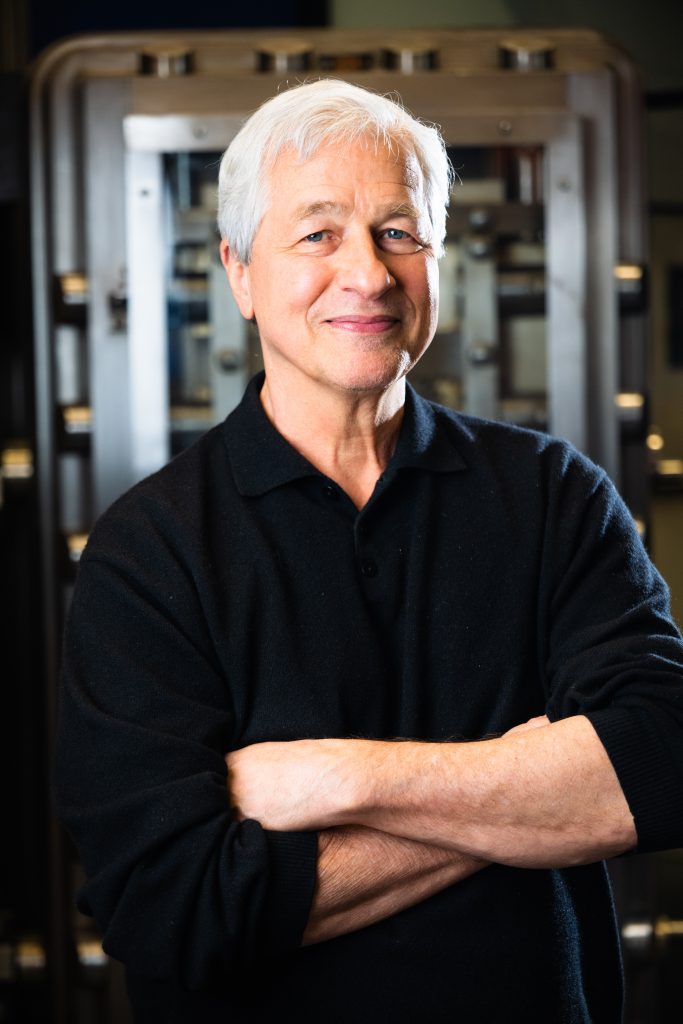

Speaking to one of the branch heads, we learned that anyone could come in, set up their laptops, sit and get right to work. The branch gave a sense of hominess . Later on in the day, we spoke with the CEO of JPMorgan Chase Jamie Dimon, and he told us that “the branch has a wall from Billy Holiday’s home and a table from Harlem Lanes.” And, customers clearly connected with these artifacts of Harlem, feeling a sense of belonging.

But, this connection extended beyond the branch’s room and decorum. It was also the efforts of the branch in bringing financial education to Harlem. Before the branches opened, as Dimon told us, “Chase invented a secure credit card for customers; you can go to the ATM, pay bills online, never overdraft, free checks, free money orders, and you have your own assigned banker”. Chase chats were also developed to spread financial advice through the lens of well-known celebrities, such as Alvin Kamara or Jay Williams.

When the Harlem Community Center branch finally opened, over “100 seminars have been given to over 3,000 people in the public space.” These seminars were not just limited to the premises. Before the pandemic, Nichol King, Community Manager of the branch, would meet Harlemites directly, predominantly through financial education in faith based organizations. Word of these events and the branch started to spread through Harlem, and people clearly felt more comfortable with banking.

This comfortability was key to expanding the number of banked in Harlem. Dimon gave his opinion on the matter, stating “you will not enter a bank if you don’t feel comfortable. We had bankers give out flyers to people walking down the street and people responded positively.” These efforts led to clear results, as, speaking to employees of the branch, investments and deposits went up by 40% and 50% respectively.

Of course, the bank’s efforts are not based upon financial gain, but rather to bring people out of the predatory financial institutions that plague low-income communities and into the banking industry that truly improves the financial lives of Americans. Dimon was adamant on this fact. Speaking on the subject, he informed us that “being unbanked does more damage than good. Each cashed check costs about $20; a money order costs $10; you have to carry a lot of cash, and over the year you will have spent $1,300. It’s outrageous.”

On the other side of the spectrum, in the banks, Dimon expressed “we have done many tests, and have found that once you open a savings account you will keep saving. On your phone you will get messages to add to your savings. Then you will open savings for your kids and more.” And, these savings will immediately improve the financial well-being of these customers. Speaking to others, we found out that simply putting $25 into a child’s savings accounts when they are born, exponentially improves their chances of going to university.

These efforts are not just in Harlem. Chase has expanded the Community Branch model to underserved communities in Minneapolis, Dallas, Los Angeles, New Orleans and Chicago. As the year goes on they hope to open 10 more branches, each with their own unique look, bringing the same success found in Harlem to other communities.

But, Harlem’s branch came first, and with it Jamie Dimon and Chase began improving the lives of everyday Harlemites. They could sit idly by and still remain profitable, but they’re taking a chance, walking down the roads of Harlem bringing with them financial health and stability.

What Harlem branch are you talking about?? The description of the Chase space mentioned here fits none of the branches I know — 125th and St. Nick, 135th and Frederick Douglass, Broadway, etc. Also, what seminars? Never saw ads in any Chase branch inviting participation. I have a lot of questions.